Introduction

With the ever-increasing number of cyber-attacks and data breaches, banking institutions have to ensure that their customers’ personal and financial information is protected. Therefore, governments worldwide have put in place laws and regulations to protect the privacy and security of banking data. This guide aims to provide a comprehensive overview of these provisions.

Banks are required to adhere to strict guidelines regarding the collection, storage, use, and sharing of customer data. These guidelines aim at ensuring that customers’ personal information such as names, social security numbers, addresses, and account details are not used for fraudulent or malicious purposes. Furthermore, banks must ensure that their systems are secure from external attacks.

It is important for both banks and their customers to understand these privacy and security provisions since they impact how sensitive financial information is handled. In addition to being legally obligated to comply with these regulations, providing top-notch data protection also builds trust with customers who want assurance that their private information will remain safe from unauthorized access or theft.

Banking Data Privacy and Security Provisions: A Comprehensive Guide

Understanding Data Privacy in Banking

The Definition Of Data Privacy

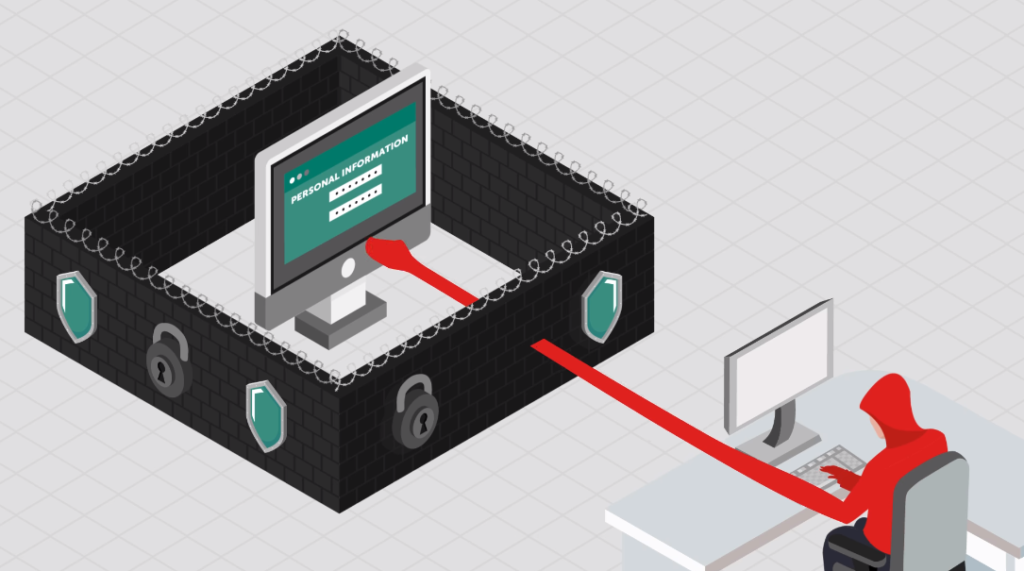

Data privacy refers to the protection and management of sensitive information about individuals, organizations, or other entities. In banking, data privacy is crucial as financial institutions hold a vast amount of personal and sensitive data about their clients. This information includes names, addresses, social security numbers, account numbers and balances, credit history, and transaction details. Protecting this data from unauthorized access or use by hackers or other malicious actors requires strict provisions for security.

The Role Of Privacy Laws And Regulations In Banking

Privacy laws and regulations play a crucial role in banking. These laws are designed to protect the privacy of customers’ data, and ensure that it is secure and used appropriately by financial institutions. The Gramm-Leach-Bliley Act, for example, requires banks to provide clear notices about their information-sharing practices with other businesses and to protect sensitive customer data from unauthorized access. Banks are also required to implement reasonable security measures that safeguard against fraudulent activities such as identity theft.

In addition to federal privacy laws, there are state-specific regulations that vary depending on the location of the bank’s headquarters or where its customers reside. For instance, California’s Consumer Privacy Act (CCPA) is one of the most comprehensive data protection statutes in the country and applies to any organization conducting business within California, including banks. This law grants consumers various rights regarding their personal information such as knowing what data is being collected about them and requesting its deletion.

These privacy laws and regulations not only protect consumers but also benefit banks by building trust with their clients. Through compliance with these provisions, banks can demonstrate their commitment to protecting sensitive information provided by customers while ensuring they remain compliant with legal standards for handling financial data.

Understanding Data Security in Banking

The Definition Of Data Security

Data security is the practice of protecting digital information from unauthorized access, theft, or damage. It encompasses a range of measures and protocols designed to ensure that sensitive or confidential data remains inaccessible to malicious actors. In the banking industry, data security is particularly important due to the sensitivity of financial transactions and personal information.

The Types Of Data Security Measures In Banking

There are different types of data security measures in banking, including physical security, network security, and application security.

Physical security involves securing the physical premises where data is stored or processed. This includes access control measures like surveillance cameras, biometric authentication systems such as fingerprint scanners, and secure storage facilities for backup tapes and servers. Network security ensures that all communication channels between different devices within the bank’s network are secured from unauthorized access by hackers or malware.

Application security concerns itself with securing software applications used by employees or customers to access banking services. This includes enforcing strong passwords and two-factor authentication mechanisms for login procedures, implementing firewalls at both server and client ends to ensure the safe transfer of data without an interception, and performing regular vulnerability testing on software applications to identify potential loopholes before they can be exploited by cybercriminals.

The Role Of Technology In Data Security

Technology plays a critical role in data security across all industries, including banking. With the increasing prevalence of cyberattacks and data breaches, banks must use advanced technology to protect sensitive customer information. Advances in authentication technologies have made it possible for banks to ensure that only authorized individuals can access customer accounts and financial information.

In addition to authentication technologies, encryption also plays a crucial role in data security. Encryption involves converting sensitive data into code that cannot be read by unauthorized parties. By using encryption technology, banks can protect confidential customer information from being accessed or stolen by hackers.

Another way technology is used to enhance banking data security is through the implementation of firewalls and intrusion detection systems (IDS). Firewalls are designed to prevent unauthorized access to a bank’s network while an IDS system monitors network activity for signs of potential attacks or suspicious behavior in real-time. These systems work together to provide comprehensive protection against various forms of cyber-attacks on banking systems, ensuring that customers’ financial information remains safe and secure.

Why Data Privacy and Security Matters in Banking

The Impact Of Data Breaches On Banking Customers

Data breaches often involve the theft of personal information, such as names, addresses, social security numbers, and credit card details. When this happens, customers may experience fraudulent activity on their accounts or even identity theft.

The Financial Consequences Of Data Breaches For Banks

Data breaches can have significant financial consequences for banks. The direct cost of a data breach includes notification and investigation expenses, legal fees, and credit monitoring services for affected customers. In addition, there are indirect costs such as reputational damage that can result in lost customers and decreased revenue.

Furthermore, data breaches can lead to regulatory fines if the bank is found to be non-compliant with data protection laws. These fines can range from thousands to millions of dollars depending on the severity of the breach and the number of affected customers.

Banks also face potential lawsuits from customers who have suffered financial losses or identity theft as a result of the breach. These lawsuits can quickly add up to substantial sums, further impacting a bank’s bottom line.

The Importance Of Trust In The Banking Industry

The banking industry operates on the premise that clients can trust them with their money, personal information, and assets. Banks invest heavily in security systems to ensure data privacy and protect customer information from unauthorized access. They also comply with regulatory requirements to ensure that they are transparent about how they handle client data.

Banks must invest in robust security measures continually while being transparent about how they handle customer data if they hope to maintain or regain customer loyalty and trust over time.

Banking Data Privacy and Security Provisions

An Overview Of Banking Data Privacy And Security Provisions

Banks have put in place robust privacy and security provisions that outline the measures they take to safeguard customer data.

Some of these provisions include two-factor authentication for online banking transactions, encryption of sensitive data during transmission and storage, regular security audits and assessments to identify vulnerabilities in their systems, as well as strict access controls and permissions for employees who handle customer information. Additionally, banks may also provide customers with options to opt out of certain types of marketing communications or third-party sharing of their information.

The Key Components Of A Data Privacy And Security Program

The key components of a data privacy and security program in the banking industry include risk assessment, data classification, access controls, encryption, incident response planning, and testing. Risk assessment is crucial to determine the potential risks that can impact personal or sensitive data. It enables banks to identify threats and vulnerabilities while taking appropriate measures to mitigate them.

Data classification involves categorizing information according to its sensitivity level. This allows banks to apply different security protocols based on the level of risk associated with each category.

Access controls ensure that only authorized personnel can access sensitive information. Banks must have strict authentication procedures for employees accessing customer data.

Encryption is an essential component that protects confidential information from unauthorized access by converting it into a code format that only authorized parties can read. Incident response planning involves developing strategies for dealing with cybersecurity incidents such as hacking, phishing attacks or other forms of cybercrime.

Testing these components regularly ensures they are functioning correctly and do not create any loopholes for cyber-attacks or breaches due to human error or technical glitches.

The regulations and laws that govern data privacy and security in banking

Some of the key laws governing data privacy and security in banking include the Gramm-Leach-Bliley Act (GLBA), The Fair Credit Reporting Act (FCRA), and Sarbanes-Oxley Act.

The GLBA requires banks to put in place measures to protect customer information such as social security numbers, account numbers, credit history, and other personal identifying information. Banks must also provide customers with a notice outlining how their personal information is collected, used, shared, or disclosed. FCRA regulates the collection of consumer credit information by providing guidelines on how financial institutions should collect credit reports from third-party companies while the Sarbanes-Oxley Act mandates public companies including banks to disclose financial transactions transparently as well as implement controls for electronic records management.

Risk Assessment in Banking

The Importance Of Risk Assessment In Banking Data Privacy And Security

Risk assessment is an integral part of the banking industry’s approach to data privacy and security. It involves identifying potential risks, evaluating their likelihood and impact, and implementing measures to prevent or mitigate them. A thorough risk assessment helps banks identify vulnerabilities and take proactive steps to protect customer information.

An effective risk assessment framework should be tailored to the specific needs of each bank. It should take into account factors such as the bank’s size, operations, IT infrastructure, regulatory environment, and customer base. The framework should also involve regular monitoring and review of risks to ensure that it remains up-to-date with emerging threats.

Types Of Risks Associated With Data Privacy And Security

Cybersecurity risks: Banking systems are highly vulnerable to cyber-attacks due to their large volumes of sensitive financial data, making them a prime target for hackers. Cybersecurity risks include phishing attacks, ransomware attacks, malware attacks, and social engineering attacks which can result in significant financial loss and damage to reputation.

Regulatory compliance risks: Banks are subject to stringent regulatory requirements and non-compliance could lead to legal penalties or reputational damage. Compliance risks include failure to comply with data protection regulations such as the General Data Protection Regulation (GDPR) or breach notification requirements under the New York State Department of Financial Services cybersecurity regulation.

Insider threats: Banking employees have access to sensitive customer information which puts them in a unique position of trust. However, this also makes them potential insiders who may misuse or intentionally disclose confidential information leading to reputational damage, legal liabilities, or fraud.

Risk Assessment Methodologies In Banking

There are various methodologies used in assessing risks in banking. One of the commonly used methods is the quantitative risk assessment method, which involves evaluating potential losses using statistical models and financial data. This method uses numerical analysis to determine the probability of risk occurrence and its potential impact on business operations.

Another methodology used in risk assessment is qualitative risk assessment, which involves analyzing factors such as reputation, legal compliance, and operational effectiveness that may lead to a loss. The analysis is based on expert opinions and subjective judgments rather than numerical data.

Furthermore, scenario-based methodologies are also utilized by banks to assess risks. This approach involves creating hypothetical scenarios that could lead to a loss and then analyzing their impact on business operations. It helps banks identify potential vulnerabilities, develop appropriate control measures, and prepare for unexpected events that may arise.

Best Practices for Banking Data Privacy and Security

Encryption And Data Masking

Encryption involves encoding the data in such a way that only authorized parties can access it. This process ensures that even if an unauthorized person gains access to the data, they cannot read or interpret it without the encryption key. Encryption technology is widely used in banking systems to protect personal identification numbers (PINs), credit card numbers, and other confidential information.

Data masking is another technique that helps banks safeguard their clients’ information. It involves replacing specific characters or values with random ones, thereby hiding the original information while still maintaining its essence. This approach protects against unauthorized users who might exploit weaknesses in security protocols and access sensitive customer data.

Access Controls And Identity Management

Access controls and identity management play a critical role in ensuring the privacy and security of sensitive banking data. Access controls refer to policies and procedures that restrict access to information systems, applications, and data based on an individual’s job responsibilities and clearance level. Identity management, on the other hand, is the process of managing user authentication, authorization, and accountability across various IT systems.

To implement effective access controls and identity management policies in a banking organization, it is essential to define roles and responsibilities clearly. This includes designing access control policies that limit unnecessary privileges to prevent insider threats from employees with malicious intent or those who accidentally compromise sensitive data. Additionally, banks must ensure that they employ strong password policies such as mandatory password changes after specific periods.

Identity management solutions based on multi-factor authentication can be used to secure bank accounts further. By using biometrics like fingerprints or facial recognition technology along with traditional passwords in online transactions can provide an additional layer of security for customers’ bank accounts.

Data Retention And Disposal Policies

These policies outline the duration of time that specific types of data will be kept and when they should be permanently deleted. The retention period can vary depending on the type of data, its sensitivity, and legal requirements.

In addition to outlining the retention period, these policies also specify how data should be disposed of securely. Data disposal methods may include shredding physical documents or permanently deleting electronic files using specialized software. Disposal procedures must comply with regulatory requirements to avoid penalties.

Employee Training And Awareness Programs

In the banking industry, protecting customer data is crucial, and employee training plays a vital role in safeguarding this information. Training must cover privacy policies, security protocols, and best practices for handling sensitive information.

Effective awareness programs must also be implemented to help employees understand the importance of maintaining data privacy and security. These programs can include regular reminders of company policies on cybersecurity and data protection. By reinforcing these policies regularly, employees will become more aware of their responsibilities towards safeguarding confidential customer records.

Incident Response Planning

Incident response planning is a critical component of any comprehensive data privacy and security program for banks. In the event of a data breach or other security incident, having a plan in place can help minimize damage and ensure swift resolution. An effective incident response plan should include clear procedures for identifying and containing breaches, notifying affected parties, investigating the cause of the incident, and implementing remediation measures.

To develop an effective incident response plan, banks should conduct regular risk assessments to identify potential vulnerabilities in their systems and processes. They should also establish clear roles and responsibilities for key personnel involved in responding to incidents, including IT staff, legal counsel, customer service representatives, and public relations professionals. Additionally, banks should consider partnering with third-party experts who can offer specialized expertise in areas like digital forensics or crisis management.

Conclusion

Banking data privacy and security provisions are essential for safeguarding sensitive financial information. The regulations and guidelines set by regulatory bodies must be followed strictly to ensure that customer data is protected from unauthorized access or theft. Financial institutions must invest in robust cybersecurity measures, including encryption tools, firewalls, and multi-factor authentication systems to secure their databases.

Moreover, banks should also maintain a culture of privacy and security awareness among their employees through regular training programs. This will help prevent internal data breaches caused by human error or intentional misconduct. In summary, the implementation of strong data protection policies will not only protect customers’ personal information but also strengthen the reputation and credibility of financial institutions in the market.